Objectives

We seek

to evaluate the accuracy of computational intelligence (CI)

methods in time series forecasting, extending the earlier

NN3 forecasting competition unto a new set of daily data.

We hope to

evaluate progress in modelling neural networks for forecasting & to disseminate

knowledge on “best practices”. The competition is conducted for academic purposes

and should not be exploited commercially.

Methods

The prediction competition is open to all methods of computational

intelligence, incl. feed-forward and recurrent neural networks,

fuzzy predictors, evolutionary & genetic algorithms, decision & regression tress, support vector

regression, hybrid approaches etc. used in financial forecasting,

statistical prediction, time series analysis. We also welcome

submission of statistical methods as benchmarks, but they

are not eligible to "win" the NN5.

Dissemination &

Publication

of Results

All those submitting predictions will be invited to

participate in sessions at the 2008 International

Symposium on Forecasting, ISF'07,

Nice, France, the 2008 IEEE

World Congress on Computational Intelligence, Hong Kong,

China, held simultaneously with the

2008 IEEE International Joint

Conference on Neural Networks, IJCNN'08, the

2008 Congress on Evolutionary

Computation, CEC'08 and the

2008 International Conference on Fuzzy Systems FUZZ-IEEE'08,

or the

2008 International Conference on Data

Mining, DMIN'08, Las Vegas. Each workshop will provide awards by dataset for students and non-students.

We are currently negotiating with various publishing houses

for a journal special issue for all accepted submissions.

|

Forecasting

Problem Forecasting

Problem

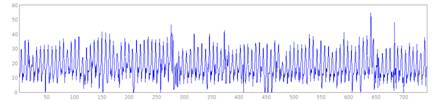

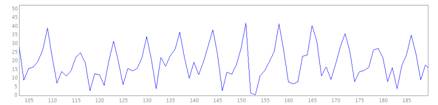

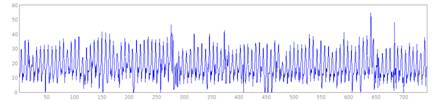

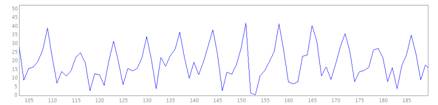

Forecast a set of 11 or 111 daily time series

of cash money

withdrawals

at cash-machines as accurately as

possible, using methods from computational intelligence and

applying a consistent methodology.

The data consists

of 2 years of daily cash money demand at various automatic

teller machines (ATMs, or cash machines) at different

locations in England (see time series & zoom below):

Cash machines

operate as miniature “retail outlets” and provide cash money

to customers. The data may contain

a number of time series patterns including multiple

overlying seasonality, local trends, structural breaks,

outliers, zero and missing values etc. These are often

driven by a combination of unknown and unobserved causal

forces driven by the underlying yearly calendar, such as

reoccurring seasonal periods, bank holidays, or special

events of different length and magnitude of impact, with

different lead and lag effects.

|

Forecasting

Problem

Forecasting

Problem